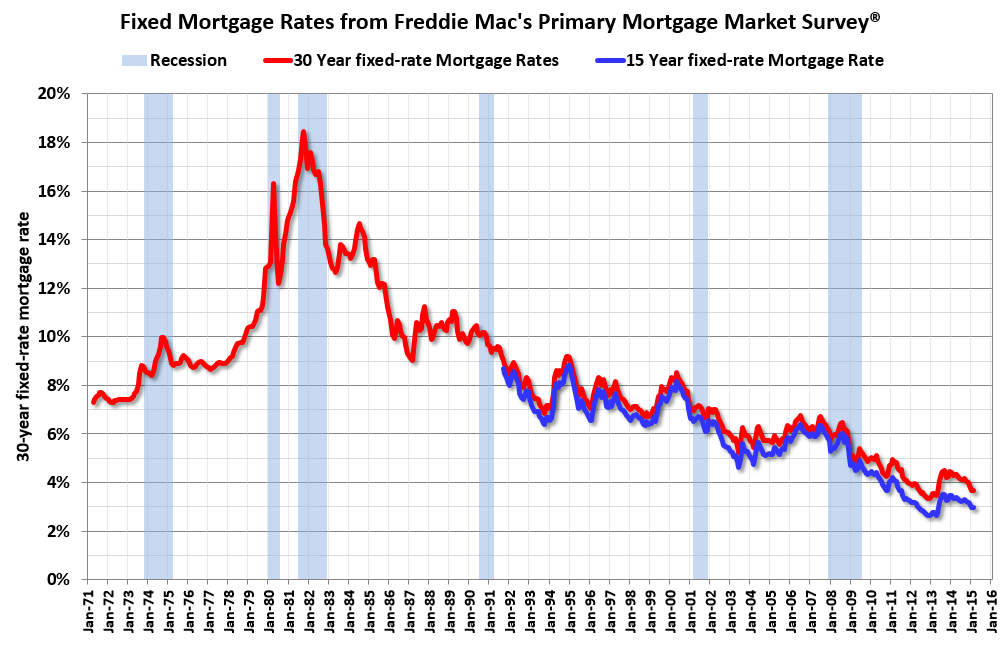

We have all heard that mortgage rates have been hovering in recent years at an all time low but you may have not seen that demonstrated. Take a look at what rates have done over the past 40 plus years.

Opportunities still exist to refinance while rates are low. For instance there are 15 year fixed mortgages in the low to mid 3′s%.

Rising mortgage interest rates are inevitable.

Lower interest rates especially effect 1st time home buyers who are seeking to attain a target payment… say that is comparable or lower then rent. In a scenario with rising mortgage interest rates you are forced to seek a lower price house to get the same payment and the choice of available homes can substantially shrink causing you to compromise.

If you are a seller rising interest rates can shrink your target buyer pool when they are driven to lower priced houses in order to qualify. So it is been widely publicized that the Fed is seeking to raise rates in the 3rd to 4th quarter of 2015. There will be a definite impact on the real estate market for the reasons identified above and more.

There are a wide range of available products that assist in keeping you payment low including taking advantage of low rates while they exist, minimizing or eliminating costly mortgage insurance among others.

Credit scores can dramatically effect rates and pricing. If your credit score is poor or somewhat compromised you can be stuck with a higher rate. However do not fret… with proper guidance improvements can be made to scores and sometimes quickly. It is not advisable to ASSUME that you cannot qualify because you feel your score is too low. There are many variables. There are credit management services, mortgage lenders that can work with you and proper guidance from a real estate professional from Pinnacle. Call us at 410-560-3556.

7,311 total views, no views today